annual federal gift tax exclusion 2022

Youd need to give away cumulative taxable gifts in excess of that amount before facing a tax liability. After four years the annual federal gift tax exclusion has increased from 15000 to 16000.

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

Starting in 2022 currently proposed legislation would reduce the annual gift tax exclusion to 10000 per year per donee recipient.

. The annual exclusion applies to gifts to each donee. The annual gift tax exclusion was indexed for inflation as part of the Tax Relief Act of 1997 so the amount can increase from year to year to keep pace with the economy but only in increments of 1000. The gift tax annual exclusion in 2022 will increase to 16000 per donee.

For 2022 the annual exclusion is 16000 per person up from 15000 in 2021. The federal government imposes a gift tax of up to 40 on transfers of property from one person to another whether its cash or a physical item. The annual exclusion is the most you can give away to or for the benefit of a single person within a calendar year without needing to file a federal gift tax return Form 709 andor reducing your lifetime exemption.

Just like your federal income tax the gift tax is based on marginal tax. The gift tax limit for individual filers for 2021 was 15000. The Public Service Labour Relations Act and the Income Tax Act Bill C-4 assented to 2017-06-19 SC 2016 c 14.

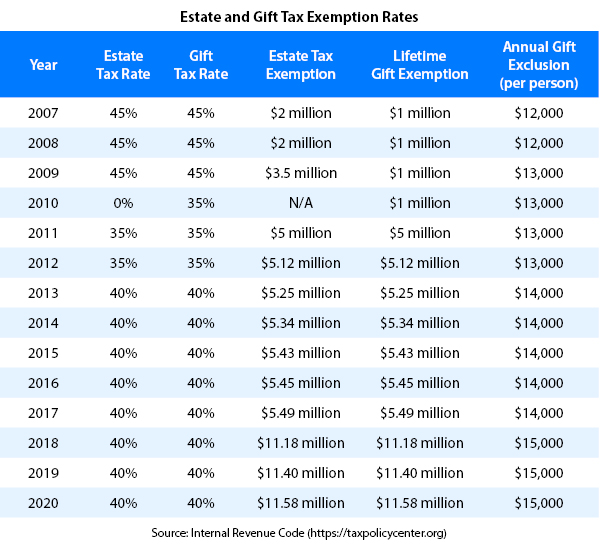

This is the first time in several years it has increased as it remained at 15000 from 2018-2021. The Internal Revenue Service IRS has received the following frequently asked questions regarding Expatriation Tax Reporting of Foreign Financial Accounts Foreign Earned Income Exclusion Individual Taxpayer Identification Number ITIN Applications and other general international federal tax matters impacting individual taxpayersThe answers to these. First gifts of up to the annual exclusion 11000 per recipient for the years 20022005 12000 for 20062008 13000 for 20092012 14000 for 20132017 15000 for 2018-2021 and 16000 for 2022 incur no tax or filing requirement.

Annual Gift Tax Exclusion. Anything above the gift tax annual exclusion should be reported to the IRS. Federal LawCivil Law Harmonization Act No.

But most gifts are not subject to the gift tax. Written by True Tamplin BSc CEPF Updated on June 16 2022. Residents of all states need to abide by federal gift tax.

For 2018 2019 2020 and 2021. For example a man could. You never have to pay taxes on gifts that are equal to or less than the annual exclusion limit.

Gift Tax Limit 2022. It is a federal tax imposed on certain transfers of any assets made as gifts without expecting anything in return. Get in-depth analysis on current news happenings and headlines.

In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or after January 1 2013 the annual exclusion applies to each gift. Notice 2014-21 2014-16 IRB. Please visit the Estate and Gift taxes page for more information regarding federal estate and gift tax.

The Annual Gift Tax Exclusion for Tax Year 2022. As one court has stated. By splitting their gifts married couples can give up to twice this amount tax-free.

2 Bill S-10 assented to 2004-12-15. Access version in force. The annual gift tax exclusion was indexed for inflation as part of the Tax Relief Act of.

When you file a gift tax return the IRS will decrease your remaining lifetime exclusion amount by the amount of your annual gift tax return. For the tax year 2021 the annual exclusion is 15000 but goes up to 16000 for tax year 2022. The annual gift exclusion is applied to each donee.

The IRS allows individuals to give away a specific amount of assets or property each year tax-free. The IRS sees you made a gift of 200000. Or a 5000000 federal estate tax exemption with full step-up in tax cost.

Read unique story pieces columns written by editors and columnists at National Post. This amount is known as the annual exclusion amount which for 2022 is 16000 per beneficiary. The annual gift tax exclusion is the amount of money or assets that one person can transfer to another as a gift without incurring a gift tax.

Gift Tax Annual Exclusion. Million exemption amountand by making lots of 16000 annual exclusion gifts that dont count against the 12 million. Now that you are aware of the gift tax limit for 2022 you know that your gift limit per recipient is a value of under 16000.

In 2022 this gift exclusion is 16000 per donee recipient. Contact the tax experts at Pacific Tax Financial Group for all of your tax needs and for quick and accurate tax returns. The gift tax annual exclusion allows taxpayers to make certain gifts without eroding the taxpayers lifetime exemption amount.

Following the above example if you keep annual gifts below 16000. As an example an elderly woman with 3 adult children and. In 2022 the annual gift tax exemption is 16000 up from 15000 in 2021 meaning a person can give up 16000 to as many people as they want without having to pay any taxes on the gifts.

However you may still avoid paying a gift tax if you go above the annual exclusion limit of 15000 for 2021 or 16000 for 2022. However as the law does not concern itself with trifles Congress has permitted donors to give a small amount to each beneficiary of their choosing before facing the federal gift tax. It increases to 16000 for.

As of 2022 this amount is 1206 million. The specific amount is known as the annual gift exclusion. The IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels.

This allows donors to gift up to a certain amount tax-free. For tax years beginning after 2017 reimbursement you receive from your employer for the purchase repair or storage of a bicycle you regularly use for travel between your residence and place of employment must be included in your gross income. For instance you can give up to the annual exclusion amount 15000 in 2021 to any number of people every year without facing any gift taxes.

For 2022 the annual gift exclusion is being increased to 16000. Since Jun 23 2022 current. The annual exclusion for 2014 2015 2016 and 2017 is 14000.

For the past four years the annual gift exclusion has been 15000. Every year the IRS sets an annual gift tax exclusion. There is no limit to how many persons a donor is allowed to give.

Suspension of qualified bicycle commuting reimbursement exclusion. Why it pays to understand the federal gift tax law. The federal government imposes a tax on gifts.

How the gift tax is calculated and how the annual gift tax exclusion works In 2021 you can give up to 15000 to someone in a year and generally not. What Is the Annual Gift Tax Exclusion. What is a Gift Tax.

The lifetime gift tax exclusion refers to the cumulative amount of taxable giving you can do before the IRS levies a gift tax. That tax is usually paid by the donor the giver of the gift. We have all the details on 2022 tax.

If you give people a lot of money or property you might have to pay a federal gift tax. This statute is current to 2022-08-08 according to the Justice Laws Web Site. Gift Tax 2022 What It Is Annual Limit Lifetime Exemption and Gift Tax Rate.

For 2019 and 2020 the annual gift tax exclusion sits at 15000. That means you can give up to 16000 to as many recipients as you want without having to pay any gift tax. What is the gift tax annual exclusion amount for 2022.

The annual gift tax exclusion of 16000 for 2022 is the amount of money that you can give as a gift to one person in any given year without having to pay any gift tax.

Gifting Time To Accelerate Plans Evercore

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

How To Avoid The Gift Tax Smartasset In 2022 Owe Money Paying Bills Tax

Gift Tax Exclusion For Tuition Frank Financial Aid

Annual Gift Tax Exclusion Increases In 2022

Understanding The Federal Gift Tax Exemption And How It Applies To You Atlanta Estate Planning Wills Probate Siedentopf Law

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Do I Have To Pay Taxes On A Gift H R Block

2022 Ohio Gift Tax Exemptions Estate Planning Attorney Dupont And Blumenstiel

Federal Estate Tax Exemption 2021 Cortes Law Firm

How Much Money Can I Gift Tax Free Gift Tax Exclusion

Can Making Lifetime Gifts Really Reduce Your Tax Liability In The Future

How Does The Gift Tax Work Personal Finance Club

Faq Is Tuition Exempt From The Gift Tax Estate And Probate Legal Group

Know The Law Annual Exclusion Offers Relief From Gift Tax Mclane Middleton

Us Gift Estate Taxes 2022 Gifts Transfer Taxes Htj Tax

Make Note Of These Estate And Gift Tax Exemption Amounts For 2022 Preservation Family Wealth Protection Planning